rhode island tax rates 2020

Find your pretax deductions including 401K flexible account. 2019 tax bills are for vehicles registered during the 2018 calendar year.

Tax rate of 599 on taxable income over 155050.

. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. Rhode Island Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 375 0 to 65250 375 of Income 475 65250 to 148350 244688 475 599 148350. 41 rows West Warwick taxes real property at four distinct rates.

Rhode Island Property Tax Rates for 2020 tax rate per thousand dollars of assessed value Click table headers to sort Tax Rates Markers. The rate so set will be in effect for the calendar year 2020. By law you are required to change.

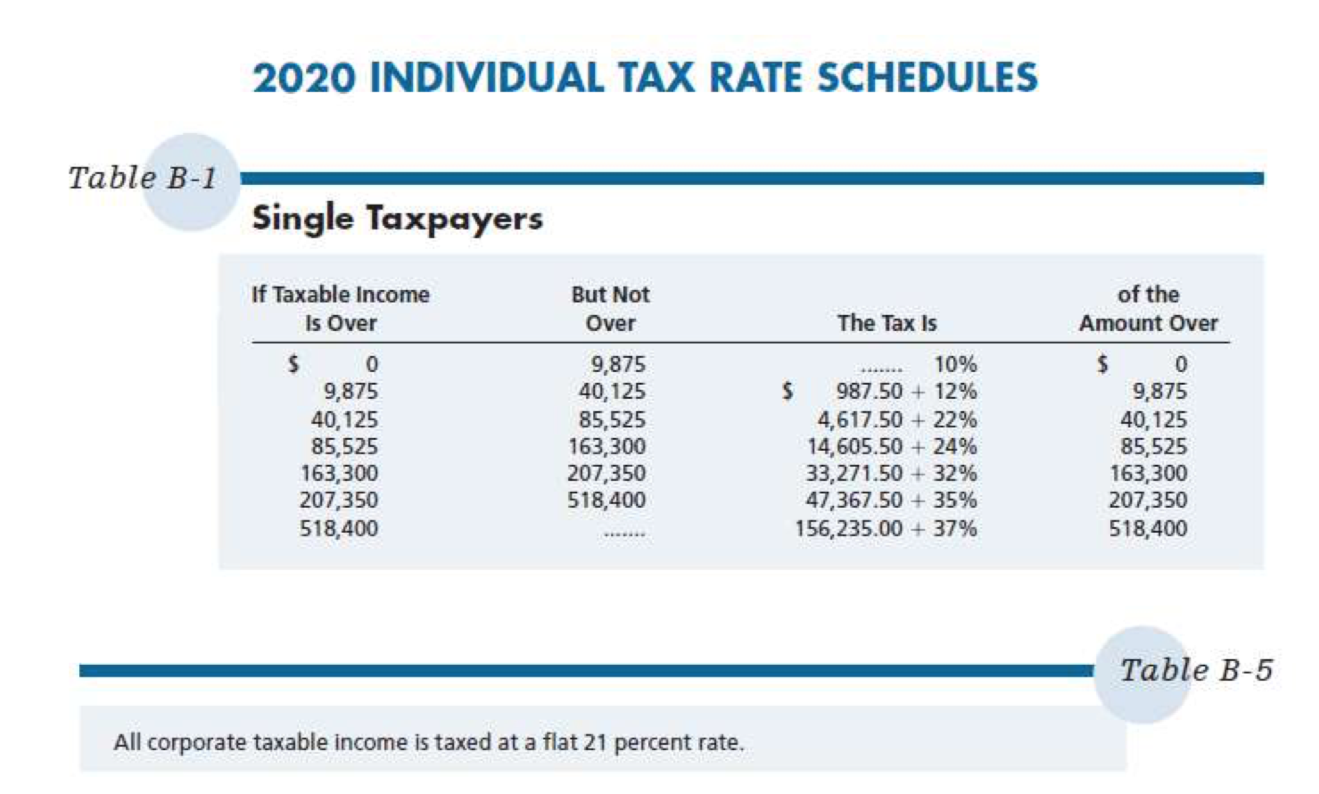

Unlike the Federal Income Tax Rhode Islands state. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax. The chart below breaks down the Rhode Island tax brackets using this model.

The Rhode Island Income Tax Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Tax rate of 475 on taxable income between 68201 and 155050. Rhode Island new employer rate.

The Rhode Island Income Tax Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Like most other states in the Northeast Rhode Island has both a. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table.

Comprehensive Plan 2020-2040. 2989 - two to five family residences 3243 - commercial I and II industrial commind. Vehicles registered in Newport RI are taxed for the PREVIOUS calendar year ie.

Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 6525000 youll pay. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a. 153 average effective rate.

2020 The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum. Rhode Island Estate Tax. Find your income exemptions.

The current tax rates and exemptions for real estate motor vehicle and tangible property. 15 15 to 20 20 Click tap or touch markers on the. 34 cents per gallon of regular gasoline and diesel.

Tax rate of 375 on the first 68200 of taxable income. 135 of home value. State of Rhode Island Division of Municipal Finance Department of Revenue.

Tax amount varies by county. About Toggle child menu. Everything You Need to Know - SmartAsset The Rhode Island estate tax rates range from 0 to 16 and applies to estates valued at 1537656 and.

2022 Child Tax Rebate Program. Unlike the Federal Income Tax Rhode Islands state. Above rates do not include Job Development Assessment of 21 or 008 adjustment for 2020.

The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

Raising Revenues To Invest In Rhode Island Economic Progress Institute

State Taxes On Capital Gains Center On Budget And Policy Priorities

How Do State And Local Property Taxes Work Tax Policy Center

Map Of Rhode Island Property Tax Rates For All Towns

Tax Withholding For Pensions And Social Security Sensible Money

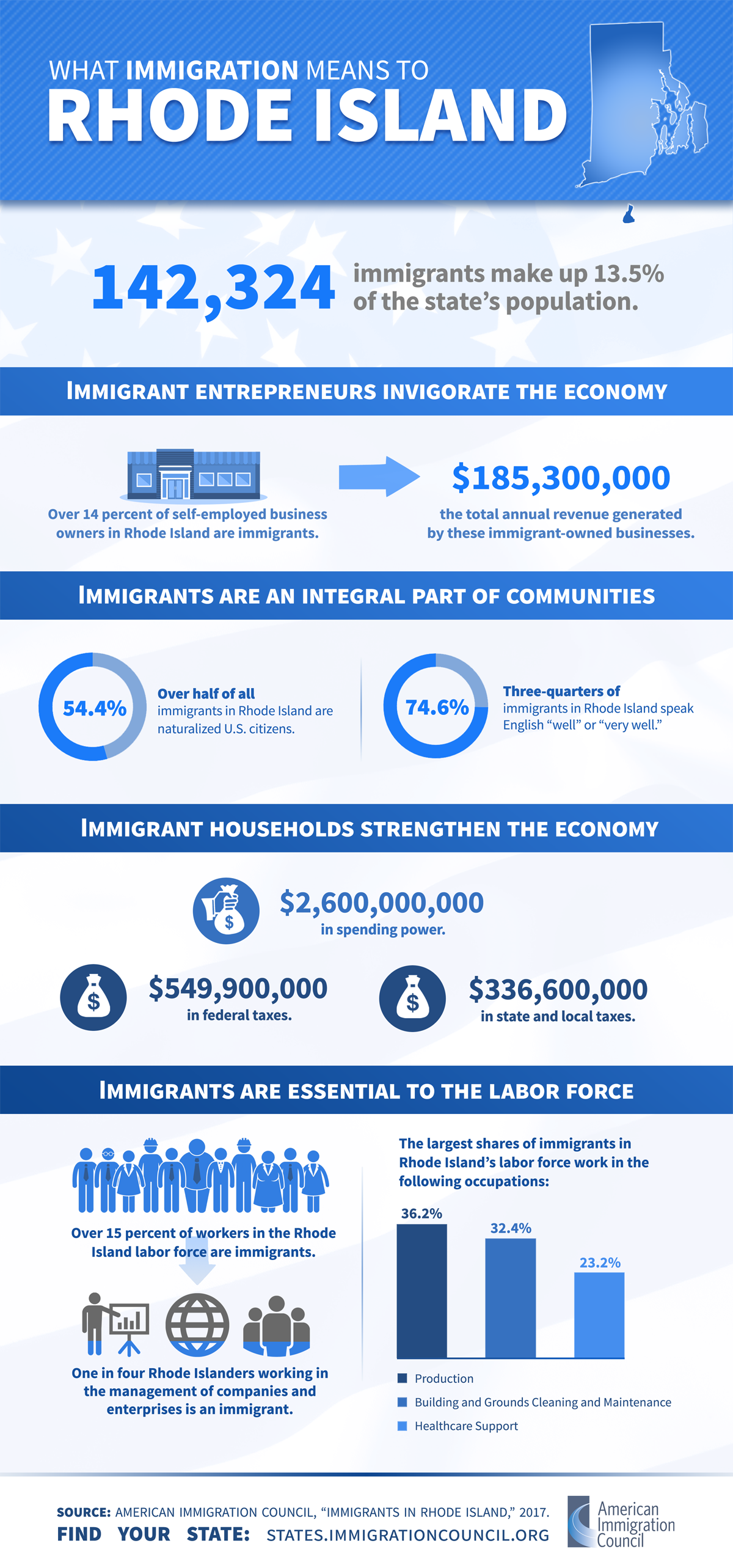

Immigrants In Rhode Island American Immigration Council

Rhode Island Income Tax Ri State Tax Calculator Community Tax

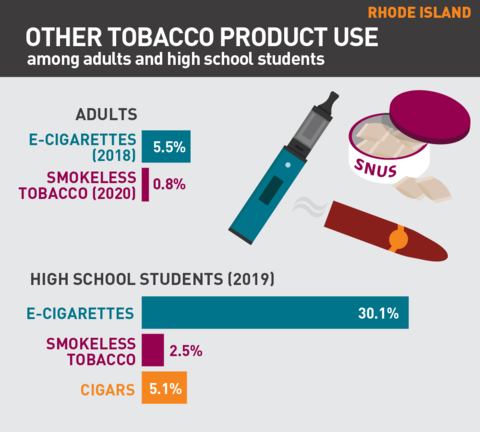

Tobacco Use In Rhode Island 2021

General Income Tax Factors Fringe Benefits Lo 3 Chegg Com

Moving To A Low Tax State Can Be An Expensive Way To Save Money The Washington Post

Please Get To The Polls On October 22 2020 For The All Day Budget Referendum Coventry

Ri Health Insurance Mandate Healthsource Ri

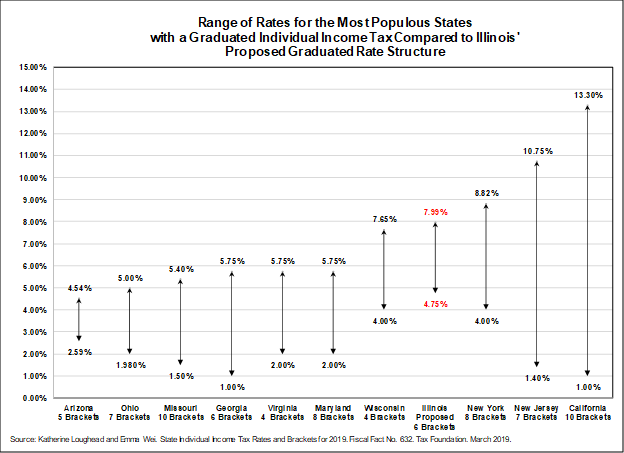

Individual Income Tax Structures In Selected States The Civic Federation

Rhode Island State Tax Tables 2021 Us Icalculator

Sales Tax On Grocery Items Taxjar

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

Get And Sign Form T 204r Annual Rhode Island Division Of Taxation Ri 2020 2022

Rhode Island Key Performance Indicator Briefing For Q4 2021 Ri S Post Pandemic Economy Grows But Still Lags The Nation In Recovering Jobs Rhode Island Public Expenditure Council